Introduction

Hi dears, another interesting project is being started. First of all, for who missed previous entry, what's a cryptocurrency? To be fast and concise, it is a digital medium of exchange. And the next question would be... What's your use? It is also easy to guarantee the security, integrity and balance of your financial statements by means of a network of agents (segmented file transfer or multisource file transfer) that verify

All this racket of cryptomoney has been increasing exponentially, however, most people know nothing about how blockchain technology works, what a smart contract is and how it could be used. For this very reason, I will first of all carefully introduce this type of block chain technology.

Blockchain is a decentralized general ledger. It is a computer network that has an identical copy of the database and changes its status (records) to a common agreement based on pure mathematics. All this means that there is no need for any central server or any entity we trust (e.g. central bank, notaries, banks, paypal, etc.). The blockchain is the technological basis for all cryptomontages, whether Bitcoin, Ethereum, Hyperledger, etc.

When you are investing, the goal is to put money to work today and allow it to increase 3x, 5x, or even 100x and more, so that the return you make is enough to cover the risk you take or taxes you pay.

What is Xtrade project?

XTRD is comprised of a team of veteran Wall Street trading specialists with a mission to unify the cryptocurrency exchanges. This mission has manifested in four products that are all interconnected. These products are a unified FIX API similar to ones already used for high volume trading, a Single Point of Access (SPA) for cryptocurrency exchanges to increase liquidity, a downloadable trading platform to called XTRD Pro, and a centralized Dark Pool for turning crypto into fiat. With a more secure and concrete infrastructure, entities such as banks, hedge funds, and large institutional traders can easily access cryptocurrency markets.

TRADE will be launching a new cryptocurrency trading platform in early 2018 to solve the painful problems currently faced by the worldwide crypto trading community. Currently, crypto trading exists over 60 fractured and decentralized liquidity pools.

Those pools require users open multiple exchange accounts to get best prices, code to varying and undocumented API’s to access exchanges, and lack professional order entry systems. The experience is decades behind the standard of the internet and finance and is defined by slow execution speed and antiquated, unsecure web based trading.

XTRADE promises to change all that. It will simplify access to crypto, increase liquidity, and provide a secure, modern trading platform to crypto markets participants across the world.

The team behind XTRADE has over 30 years of extensive real-world experience building robust, battle tested trading systems in FX, Equities, Derivatives, and other instruments. They have specialist knowledge in all facets of brokerage services, execution, market data, trading platforms, clearing, settlement, algorithmic trading, and automated trading systems. XTRADE principals and advisors own crypto exchanges — and have worked in active trading firms all over the world as well as large financial institutions such as Goldman Sachs, Barclays, Lehman, Deutsche Bank, Morgan Stanley, and JPMorgan in technology, operational, and sales roles.

XTRADE will release a unified, familiar FIX API to allow institutions easy access to all exchanges with one simple interface at latency 100x lower than current crypto trading standards.

XTRADE Pro, a secure downloadable trading platform will be released following the launch of the FIX API. Pro will feature consolidated order books that will display prices across all exchanges in real time, hotkey order entry, and custom order types. Later in 2018, XTRADE will set up liquidity pools at all major exchanges and allow clients to trade across numerous exchanges with just ONE account at a partner exchange, while assuming all counterparty risk.

The FIX API has been completed and is already in production. XTRADE is setting up co-locations at major data centers all over the world and already connecting to multiple exchanges in 2017.

XTRADE aims to make it easier for institutional investors to invest in cryptocurrencies. To do that, XTRADE will launch a FIX API that connects to all major cryptocurrency exchanges. This will make it easier for hedge funds, institutions, and algorithmic traders to access all cryptocurrency markets by coding to just one FIX application – in one single format – with which they are already intimately familiar.

The company also plans to launch XTRADE Pro in 2018. That platform will be a multi-exchange, standalone trading platform built for active traders. It will feature things like advanced consolidated order books, hotkey order entry, and custom order types, with 24×7 uptime.

A third XTRADE product will be its Single Point of Access, or SPA, which will aggregate liquidity across exchanges. XTRADE’s SPA will be facilitated via Joint Venture (JV) partnerships with existing exchanges, helping to minimize regulatory hurdles as XTRADE will function purely as an execution technology provider.

How does Xtrade work?

As the main task of XTRADE lies in creating the immense trading infrastructure in the crypto world, the project must become one of the leading stores with full-services offered globally. The key work principles of the given promising platform include the following ones:There’s also the big liquidity pool.

The most attractive rates are guaranteed here.

The superior selection of book execution net of fees;

The fees set for transactions are symbolic.

Everything works 24/7 without any glitches.

The individual market influence is lessened.

The company has the US-based always ready to assist technical support.

The following problems are associated with cryptocurrency trading:

A complex web of exchanges

A combination of differing KYC policies associated with APIs, funding, and interfaces will result in a fragmented patchwork of liquidity for the cryptocurrency. Major concerns for traditional cryptocurrency market participants range from liquidity and hacking prevention to unmitigated slippage and counterparty risks.

High fees

The exchange commissions associated with trading of cryptocurrencies typically are in 0.1%-0.25% range per transaction, which are 10 to 25 basis points. The effective fees of transactions are much higher when taken into spreads and bids maintained by the exchanges.

There is generally no central regulator or authority for examining internal exchange orders that systematically separates customer activity from proprietary activity, which can ensure fair pricing.

Thin liquidity

If not managed correctly and executed only on the exchange, a single order to purchase USD1,000,000 worth of cryptocurrency can cost an additional USD50,000-USD100,000 per transaction to the investors due to the lack of liquidity.

Xtrade's Feature and Benefits

The platform has been developed by the team of highly professional experts and the huge row of necessary arrangements have been done for making it working perfectly all around a clock. Choosing XTRADE the customers can get:Constant online access to the platform via the IPSec control. And everybody can feel totally safe regarding the connection, transactions, all the personal data etc. as the traffic is encrypted.

Criss-cross contact option is available inside the datacenter.

There are the co-location services that allow the platform members to rent 1U or 2U slots and this in its turn makes it possible to set up the customers’ servers inside the XTRADE network.

In addition, the VPS server can be leased as well. This handling is helpful for ensuring the fast and permanent deployment of many possible OS images to choose from.

You can also find here the SMART which, to be honest, is highly adorable by traders in many countries. The thing is that in this particular case, the execution engine is capable of choosing the most appropriate execution variant in the totally automatic way. The secret of this smart trick is hidden in learning the whole previous and especially nowadays market circumstances and trading backwards.

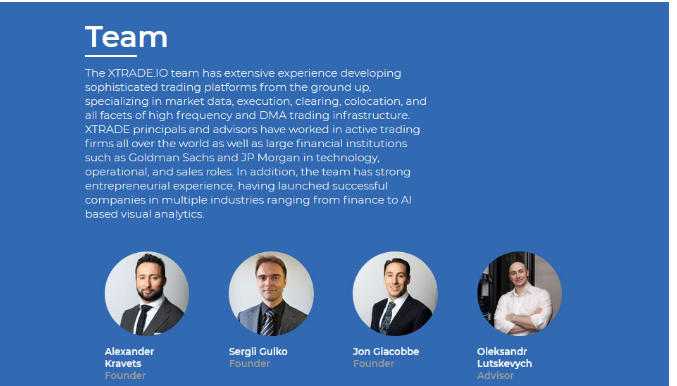

Xtrade's TEAM

XTRADE’s team has experience developing trading platforms at financial institutions like Goldman Sachs and JP Morgan. Key members of the team include founders Alexander Kravets, Sergii Gulko, and Jon Giacobbe.

The company lists CME Group, Marcum, and ZagTrader as its partners. The company is based at 110 Wall Street in New York.

Token Sale Infomation:

Token Name: XTRD Token

Token Symbol: XTRD

Rate:1ETH = 10,000 XTRD

PRE-ICO Start Date: 28 / February / 2018

PRE-ICO END Date: 10 / March / 2018

ICO Start Date ICO: 11 / March / 2018

ICO End Date ICO: 01 / April / 2018

For more information:

Website: https://xtrade.io/

Whitepaper: https://xtrd.io/xtrd_whitepaper.pdf

Telegram: https://t.me/xtradecommunityFacebook - https://www.facebook.com/xtradeio/

Twitter - https://twitter.com/xtradeio

Reddit - https://www.reddit.com/r/XtradeIO/

Medium - https://medium.com/xtradeio

author:salsa24

https://bitcointalk.org/index.php?action=profile;u=1388145

Twitter - https://twitter.com/xtradeio

Reddit - https://www.reddit.com/r/XtradeIO/

Medium - https://medium.com/xtradeio

author:salsa24

https://bitcointalk.org/index.php?action=profile;u=1388145

Tidak ada komentar:

Posting Komentar